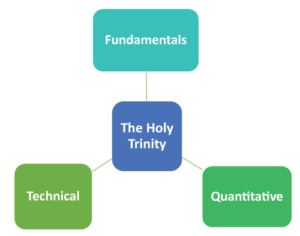

Our philosophy draws from a multitude of investment and trading greats from whom we have learnt invaluable lessons.

We do not consider ourselves purists, but prefer to blend investment philosophies to take advantage of prevailing opportunities.

We look at value and growth prospects, combine active and passive strategies while being cautious against overtrading, use both subjective and objective analysis and favour a top-down over a bottom-up approach.

We are firm believers in Behavioural Finance and recognise the role played by investor psychology in driving asset prices.

We believe markets and investors are normal, not irrational, which creates the tendency for asset prices to deviate far from their theoretical intrinsic values.

While many traditional investors frown upon speculation, intelligent speculation has proven to be a great way to generate excess alpha in portfolios. By trading derivatives in the most liquid financial instruments, excess returns can be generated with minimal risk.

| Basis for Comparison | INVESTING | SPECULATING |

| Decision Criteria | Fundamental Analysis Quantitative Analysis Economic Analysis |

Technical Analysis Market Psychology Subjective Analysis |

| Time Horizon | Long-term | Short-medium-term |

| Level of Risk | Moderate | High |

| Purchase Consideration | Cash | Leverage: margin |

| Asset Class | Equities Bonds Unit Trust ETF |

Derivatives Futures Option Contracts for Difference (CFD) Direct Commodities Forex Crypto currencies |

| Expected Rate of Return | Moderate | High |

Multi-Asset Approach

Traditional approach to equities with a long-term buy and hold approach.

- Maximise short-selling opportunities by shorting global stock market indices via futures and CFDs.

- *We trade the direct index and not an ETF tracker

- To get exposure to commodities, traditional fund managers either buy commodity stocks or ETFs that track a specific commodity. Trading the commodity directly, i.e. Gold (XAU/USD), via futures, is a very efficient way to get exposure to the price movements of the commodities without owning the physical commodity.

- The Foreign Exchange (Forex) market is the largest and most liquid asset market.

- The trading volumes and ability to transact in varying trade volume sizes via futures or CFDs makes this a prime market for short-term trading and alpha generation.

- The most speculative market, the most volatile and the “asset class” with the best risk-adjusted returns of the last decade. We believe cryptos are here to stay and acknowledge that they are purely for speculation. We advocate that cryptos be recognised by regulatory authorities as an asset class.

Fundamental Analysis Framework

We compare companies in the same industry using Ratio Analysis to select the best option.

Technical Analysis Framework

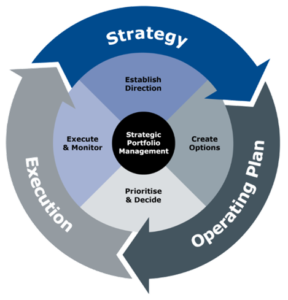

The Investment Process

- Generate Ideas

- Quantitative Evaluation

- Technical Analysis Evaluation

- Fundamental Analysis and Valuations

- Portfolio Construction and Risk Management

- Review and Monitor Portfolio

-

Screen a wide universe of stocks based on in-house criteria.

-

Identify shares within the investment universe.

-

Evaluate stock risk using absolute and relative measures such as correlation, variance, covariance and standard deviation.

-

Determine the stock’s alpha and beta relative to the market.

-

Visualise variability of returns and risk via frequency distributions.

-

Regression analysis.

-

Analyse share price trends and cycles.

-

Evaluate share liquidity.

-

Evaluation of business model, financial structure and management.

-

Analysis of historical trends in key metrics such as revenue, EBITDA, profit margins and cash flows.

-

Determine intrinsic value using traditional measures such as Discounted Cash Flows and Relative Valuation.

-

Build diversified portfolio with a focus on capital growth with a bias towards low volatility of revenues and healthy balance sheet.

-

Manage risk with attention to sector diversification and share weightings.

-

Review investment rationale periodically to capture changes in fundamentals.

-

Rebalance portfolio were necessary.